U.S. shares tumbled on Friday within the instant aftermath of sweeping new tariffs issued by President Donald Trump. A weak jobs report intensified the selloff, as a downward revision of prior estimates indicated a hiring slowdown had begun in Might as preliminary tariffs took maintain.

The mixture of elevated tariffs and sluggish hiring might hurtle the U.S. towards an financial double-whammy referred to as “stagflation,” through which the financial system slows whereas costs rise, analysts from Moody’s Analytics, accounting agency EY and Fitch Rankings advised ABC Information.

Such a prospect might pose a problem for the Federal Reserve, which dangers heating up inflation additional if it lowers interest rates or tipping the U.S. right into a recession if it raises charges.

The most recent jobs information quantities to a “vivid pink flare that the financial system is being harm by the tariff coverage,” Mark Zandi, chief economist at Moody’s, advised ABC Information. “And that is earlier than the tariffs are absolutely applied.”

Trump’s government order late Thursday laid out charges to be utilized towards practically 70 nations, starting from 10% to 41% in what a Trump administration official hailed as the start of a “new system of commerce.” The brand new duties at the moment are set to enter impact on Aug. 7.

The brand new levies hiked the typical efficient tariff price to 18.3%, the best since 1934, the Yale Budget Lab mentioned.

The tariffs introduced late Thursday got here hours earlier than a jobs report on Friday morning confirmed a marked cooldown in hiring.

The U.S. added 73,000 jobs in July, which got here in effectively under a mean of 130,000 jobs added every month this yr, in response to information from the U.S. Bureau of Labor Statistics (BLS).

The report additionally supplied new estimates for 2 earlier months, considerably dropping the federal government’s estimate of jobs added in Might and June. Over these two months, the U.S. added a mixed 33,000 jobs, a lot decrease than a earlier estimate of 286,000 jobs, BLS information confirmed.

Trump fired the BLS commissioner after the roles report was launched on Friday.

“Now we have now proof that certainly job development has slowed considerably over the previous few months,” Gregory Daco, chief economist at accounting agency EY, advised ABC Information.

The Trump administration described the downward revisions as an unwelcome signal for the U.S. financial system.

“Clearly, they are not what we wish to see,” Stephen Miran, chair of the White Home Council of Financial Advisors, mentioned on Friday.

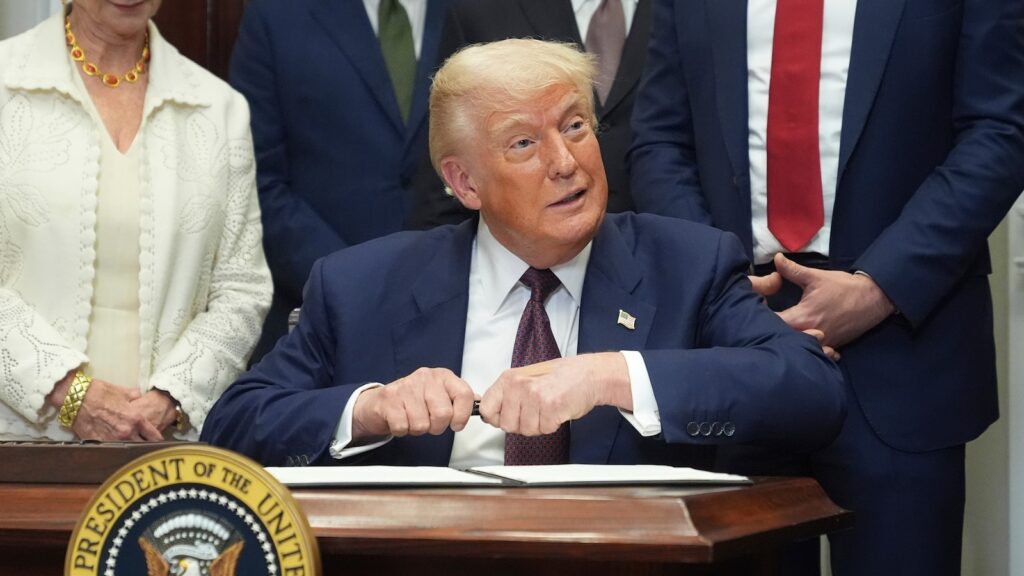

Donald Trump indicators an government order restarting the Presidential Health Take a look at in public colleges, July 31, 2025, within the Roosevelt Room of the White Home in Washington.

Jacquelyn Martin/AP

Miran blamed the weak efficiency partly on uncertainty tied to the destiny of Trump’s domestic spending legislation in addition to the last word final result of the tariff coverage. Congress handed Trump’s spending measure earlier this month; extra not too long ago, Trump introduced a contemporary spherical of tariffs late Thursday.

“Each of these sources of uncertainty are resolved,” Miran mentioned. “We anticipate issues to get materially stronger from right here, now that our insurance policies are beginning to kind into place.”

The fluctuating tariffs depart corporations with greater tax-related prices alongside continued uncertainty, casting doubt over the place bills will stand from one month to the subsequent, in response to EY’s Daco.

In response, many companies will decide to keep away from or delay funding, which dangers much less hiring and slower client spending, he added.

“We should always anticipate a extra pronounced slowdown in financial exercise over the second half of the yr,” Daco added.

The potential cooldown of financial development could coincide with an uptick of inflation, analysts mentioned, noting that importers usually cross alongside a share of the tax burden to customers within the type of greater costs.

To this point, the U.S. financial system has defied analysts’ fears of a giant, tariff-induced worth spike. However tariffs contributed modestly to the rise of inflation final month, analysts previously told ABC Information, pointing to a hike within the worth of closely imported gadgets like toys and home equipment.

Inflation stands at 2.7%, which is almost a share level greater than the Fed’s goal price of two%.

Olu Sonola, the pinnacle of U.S. regional economics at Fitch Rankings, advised ABC Information that his agency expects inflation to extend not less than a further share level by subsequent yr.

In concept, the central financial institution might assist the financial system navigate headwinds by adjusting rates of interest, however potential stagflation poses problem for the Fed.

If the Fed raises rates of interest as a method of defending towards tariff-induced inflation beneath such a state of affairs, it dangers stifling borrowing and slowing the financial system additional.

Then again, if the Fed lowers charges to stimulate the financial system within the face of a possible slowdown, it threatens to spice up spending and worsen inflation.

“It clearly presents a conundrum for the Federal Reserve going ahead,” Sonola mentioned.