this text, I replicate on the 11-year journey of the Liberia Income Authority (LRA) since its formation in 2013. I present a contextual background rooted in post-conflict governance reforms, significantly the EGAP and GEMAP initiatives. The piece highlights the Authority’s constant development in income assortment, improvements in digital taxation, and robust management transitions. I argue that Liberia can obtain a billion-dollar home income milestone if the federal government invests adequately within the LRA’s operations and modernization. The article ends with a forward-looking perspective on reforms and an emphatic name for deeper public and authorities assist.

By Danicius Kaihenneh Sengbeh, contributing author

Origins and Reform Context

In September 2013, former President Ellen Johnson Sirleaf signed into legislation an act handed by the Nationwide Legislature, establishing the Liberia Income Authority (LRA) as a semi-autonomous company mandated to evaluate, gather, and account for home income. This landmark choice was no peculiar transfer. It was a daring restructuring in a post-war nation nonetheless therapeutic from the scars of battle. The reform drew its roots from earlier governance frameworks such because the Financial Governance and Motion Plan (EGAP) and the Governance and Financial Administration Help Program (GEMAP), which had laid the groundwork for post-war Liberia’s pursuit of transparency, accountability, and financial stability. In easy phrases, the creation of the LRA was impressed by worldwide greatest practices and fueled by the pressing must overhaul a dysfunctional system that had lengthy held the nation again from conserving tempo with regional and continental reforms.

Again then, the Ministry of Finance did all of it: it made fiscal insurance policies, spent the federal government’s cash, and likewise collected the income. It was one physique, one pockets, and one pen. This type of centralized management created critical dangers for corruption, mismanagement, and lack of transparency, it was thought. There have been no clear separations between policy-making, income assortment, and spending. That association raised extra questions on transparency and accountability than solutions. It didn’t scent proper. Reform was simply unquestionably indispensable. That’s the reason the change was inevitable. The creation of the LRA, due to this fact, meant separating income assortment from coverage and spending, introducing new accountability buildings to advertise transparency, effectivity, and integrity in public finance.

So, the Bureau of Income, which operated throughout the Ministry of Finance, was carved out and reworked into what we now know because the LRA. In the meantime, the Ministry of Finance itself underwent a significant streamlining, evolving into the Ministry of Finance and Improvement Planning after absorbing the previous Bureau of the Funds and the Ministry of Planning and Financial Affairs. These adjustments have been greater than bureaucratic reshuffles. They have been designed to advertise transparency, improve accountability, and infuse larger integrity into public monetary administration, all in assist of Liberia’s improvement.

The Launch of the LRA

Quick-forward to Tuesday, July 1, 2014: the newly minted LRA, underneath Elfrieda Stewart Tamba, formally started its journey. Elfrieda and her “new child” have been now confronted with a monumental activity of assembling a reliable workforce, recruited through worldwide greatest practices, that may persistently meet annual nationwide income targets whereas cultivating taxpayer belief and voluntary compliance. The journey had begun, and the stakes have been excessive. It was taxing!

Greater than a decade has handed, and Tuesday, July 1, 2025, marked a historic milestone for the LRA. It clocked 11 years of constant service, strategic reforms, and nationwide affect. In 11 years, the LRA has transitioned from that small former Bureau of Income on the defunct Ministry of Finance into a robust engine driving Liberia’s improvement. This journey, although difficult, has been outlined by dedication, innovation, and a shared imaginative and prescient of nationwide prosperity.

In these 11 years, the LRA has carried the weighty duty of financing the nationwide price range 12 months in and 12 months out. That obligation has rested not solely on the shoulders of devoted workers but additionally on the dedication of valued taxpayers, and assist of worldwide companions as properly. Assembly the income targets assigned by the Legislature has by no means been simple, nevertheless it has all the time been the LRA’s mandate, its mission. Via all of it, the Authority has seen transformation, progress, and the emergence of a stronger, extra environment friendly tax administration.

In a particular message marking the tenth anniversary of the LRA in 2024, Commissioner Basic James Dorbor Jallah prolonged heartfelt appreciation to the hardworking staff of the Authority and the taxpayers throughout the nation for his or her unwavering patriotism. “Your contributions have performed an instrumental function within the transformation of tax administration in Liberia, and we’re proud to share the super progress we now have achieved collectively,” the CG famous. This shared effort between the LRA and the general public has led to unprecedented development in income and belief within the system.

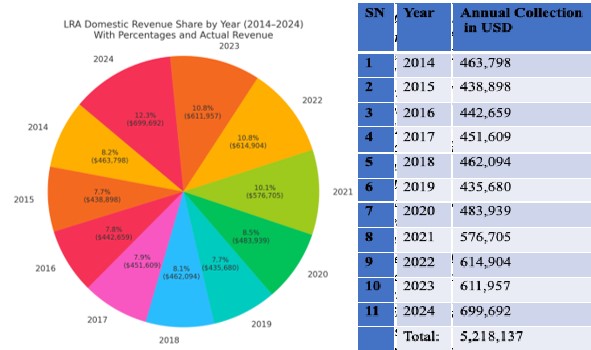

Monitoring the Development: From $463M to Practically $700M