Monrovia – Because the Liberian greenback seems to understand towards the U.S. greenback, frustrations proceed to mount amongst unusual Liberians who say that the positive aspects in alternate fee aren’t translating into actual aid on the bottom.

By Emmanuel Weedee-Conway and J.H. Webster Clayeh

Regardless of the Central Financial institution of Liberia’s (CBL) repeated assurances that the monetary system has enough liquidity in Liberian {dollars}, residents are complaining of money shortage and persistently excessive costs for fundamental items and providers.

The disconnect between official statements and street-level realities is fueling public nervousness and distrust, particularly among the many enterprise neighborhood and low-income households who rely closely on cash-based transactions.

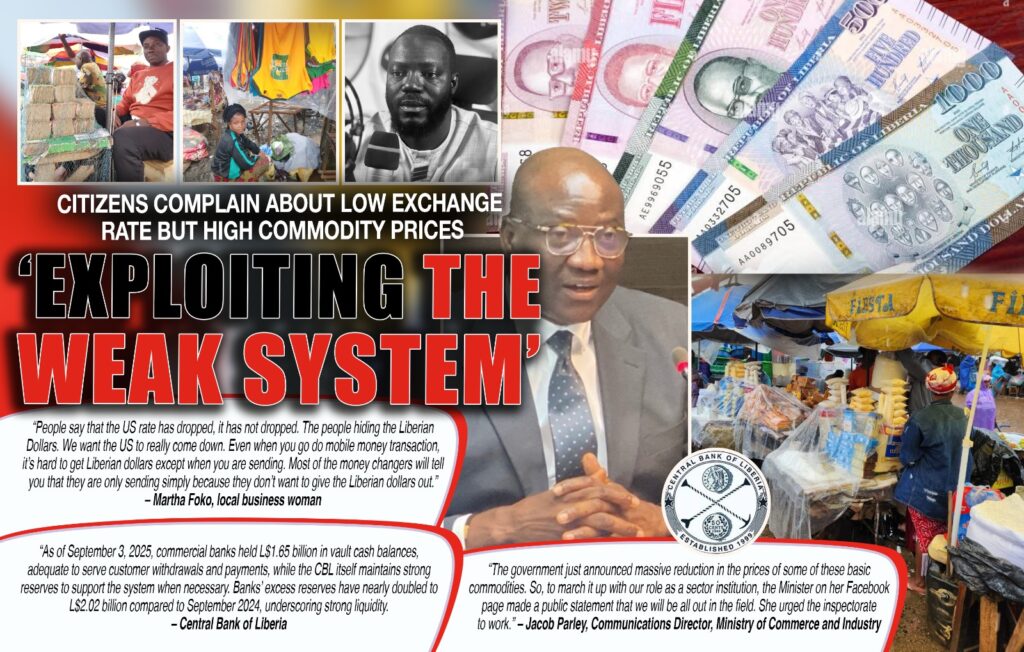

“Folks say that the US fee has dropped, it has not dropped. The folks hiding the Liberian {Dollars}. We wish the US to actually come down. Even if you go do cell cash transaction, it’s laborious to get Liberian {dollars} besides if you find yourself sending. Many of the cash changers will inform you that they’re solely sending just because they don’t wish to give the Liberian {dollars} out,” lamented Martha Foko, an area businesswoman.

Her sentiment displays the prevailing view amongst many petty merchants and on a regular basis residents who say the appreciation of the native foreign money just isn’t serving to them economically.

The CBL, nevertheless, maintains a special narrative. On September 9, 2025, the Financial institution printed a press release reaffirming that there is no such thing as a scarcity of native foreign money. “There isn’t any scarcity of Liberian {dollars} (LRD) within the monetary system. Industrial Banks keep enough Liberian greenback liquidity to fulfill buyer demand, together with authorities salaries, settlements, and personal sector transactions,” the assertion reads.

CBL additional acknowledged that as of September 3, 2025, industrial banks held L$1.65 billion in vault money balances—an quantity the Financial institution deems enough to serve buyer withdrawals and funds.

As well as, the CBL reported having sturdy reserves to intervene when vital. “Banks’ extra reserves have practically doubled to L$2.02 billion in comparison with September 2024, underscoring sturdy liquidity,” the CBL added.

Regardless of these reassurances, market dynamics appear to inform a special story. On the streets of Monrovia and throughout native markets, residents say they’re unable to money out Liberian {dollars}, even when receiving cell cash transfers. Some attribute this to deliberate hoarding by cash changers and retailers who’re allegedly stockpiling native foreign money to affect charges and costs.

Nancy Tamba, a resident of Logan City, shared her expertise: “My daughter college payment was ship to me however I can’t do withdrawals. In all places I am going no cash. The scenario may be very critical. My daughter goes to overlook class due to the shortage of Liberian greenback.”

Others, like Jacob Brown, report dropping cash in conversion because of discrepancies between official and avenue alternate charges. “Don’t know what is occurring. The speed is coming down however commodities costs aren’t coming down,” Brown mentioned.

He famous that though he exchanged his U.S. {dollars} at a fee of L$160, fundamental items equivalent to scratch playing cards nonetheless value L$200—costs that mirror no change in market situations.

The Central Financial institution, in its communication, blamed the perceived shortage on “hypothesis, hoarding, and misinterpretation” of market situations. It insisted these issues “don’t mirror Liberia’s precise Liberian greenback monetary situations, which stay secure and resilient.”

However Nimley Sayeh, President of the Nationwide Affiliation of International Alternate Bureaux of Liberia (NAFEBOL), supplied a sobering counter-narrative. Talking to FrontPage Africa, Sayeh pointed to structural and regulatory points as key drivers of the present shortage.

“It has to do with bridge in safety, lack of correct regulation, it has to do with the enterprise folks and that of the Commerce Ministry,” Sayeh mentioned.

In keeping with him, many companies are working exterior the formal banking system, additional complicating the Central Financial institution’s management over cash flows. “Which one of many nation in Africa {that a} retailer doesn’t have a checking account of their nation, companies aren’t registered,” he added.

Sayeh went additional to explain the scenario as an act of financial sabotage. “All of this stuff are methods by which folks examine and monitor monetary exercise. Who monitor the people who find themselves doing enterprise. Who monitor their monetary float. The entire thing is a whole financial system sabotage by our personal folks and our personal authorities,” he mentioned.

He additionally blamed enterprise folks for hoarding Liberian {dollars}. “There are extra money available in the market and this example most time occurs within the second 12 months of each authorities, it occurs up to now regime however this one may be very critical. The previous regime took motion rapidly. They listened to stakeholders and so they slove the issue. So we have to discovered a collaborating power to slove this drawback as a result of it’s a entire cartels,” Sayeh warned.

In the meantime, the Ministry of Commerce and Trade is urging compliance from companies and has pledged to take motion towards worth manipulation. “The federal government simply introduced huge discount within the costs of a few of these fundamental commodities. So, to march it up with our position as a sector establishment, the Minister on her Fb web page made a public assertion that we’ll be all out within the subject. She urged the inspectorate to work,” mentioned Jacob Parley, the Ministry’s Communications Director.

Current alternate fee information confirms a pointy appreciation of the Liberian greenback in latest weeks. On September 8, the alternate fee was about L$180.00 to US$1.00 (shopping for), in comparison with L$201.08 to US$1.00 on the finish of August—a ten.5% appreciation in simply over per week. A CBL market survey on September 9 confirmed L$182.94 (shopping for) and L$184.94 (promoting). The newest fee as of the time of publication was the September 10, 2025: L$176.9513 to US$1.00 (shopping for) and L$178.9114 to US$1.00 (promoting).

CBL attributes this to its tight financial coverage, together with sustaining a 17.25% coverage fee and sterilizing over L$13 billion to soak up extra liquidity. Different elements embody stronger remittance inflows—US$425.9 million within the first half of 2025—expanded street connectivity boosting rural financial exercise, and a decline in inflation from 13.1% in February to 7.4% in July.

The Financial institution added that structural modifications like improved power entry, higher street infrastructure, positive aspects in agriculture, and the usage of the Pan-African Fee and Settlement System (PAPSS) for cross-border commerce have helped reinforce confidence within the Liberian greenback.

CBL Government Governor Henry F. Saamoi reaffirmed this view: “There isn’t any scarcity of Liberian {dollars} within the monetary system. The latest appreciation of the foreign money displays sound coverage measures, structural enhancements, and enhancing financial fundamentals.

The Central Financial institution stays vigilant in safeguarding alternate fee stability, guaranteeing liquidity, and constructing confidence within the financial system.”

Regardless of these statements, the hole between coverage and actuality persists. With the alternate fee enhancing however costs holding agency, and cell cash customers struggling to money out, many Liberians proceed to really feel that the system favors the highly effective whereas burdening the typical citizen.

Because the CBL urges residents to not hoard or panic, and ministries promise enforcement, many are merely ready for his or her lives to mirror the financial “stability” being touted in press releases.