Bonita Anderson’s favourite a part of residing in Baltimore is having household close by. A household matriarch with 5 youngsters and eight grandchildren, Anderson labored onerous to purchase a spot within the metropolis for her household to name dwelling in 2009.

“It was an accomplishment for me,” she mentioned. “That is the place we used to assemble to carry the household collectively.”

Final week, what was as soon as Anderson’s cherished dwelling was listed on the market at almost $540,000 — greater than 5 occasions what she paid for it. However Anderson will not see any of the proceeds.

After greater than a decade of creating funds towards her $100,000 mortgage, Anderson was recognized with most cancers in 2020. Amid mounting medical payments and property taxes, the lifelong Baltimore resident says she had to decide on between preventing for her life and preventing for her dwelling.

Whereas present process remedy, Anderson fell behind on her property taxes by about $5,000. In 2022, she misplaced her home at a Baltimore Metropolis tax sale.

“I sat down and thought, ‘Oh my god, I am 70 years outdated and I am homeless,'” Anderson informed ABC Information Senior Political Correspondent Rachel Scott.

The Metropolis of Baltimore had put a lien on Anderson’s tax debt and auctioned it off to the very best bidder — an organization that makes a speciality of tax lien purchases — for simply $69,500.

Bonita Anderson used to stay on this home in Baltimore.

ABC Information

“If you cannot afford to pay your property taxes and you retain lacking your funds, authorities goes to public sale your property off for again taxes,” mentioned Lawrence Levy, government dean on the Nationwide Heart for Suburban Research at Hofstra College.

Courtroom data present Anderson tried to make good and redeem her dwelling, paying town $18,900 by the top of 2022 — greater than triple her excellent taxes. However as a substitute of placing these funds towards her again taxes, town utilized the cash to taxes that had accrued below the brand new proprietor.

Anderson was unknowingly paying the investor’s tax payments as a substitute of her personal, permitting the corporate to foreclose on her dwelling in 2023.

“I used to be simply baffled,” she mentioned.

‘Crammed with distortions’

Anderson’s dwelling was simply one in every of almost 44,000 Baltimore properties that had been listed at municipal tax gross sales from 2019 by means of 2023. It was additionally among the many 92% of these properties positioned in majority-nonwhite neighborhoods — which account for 70% of parcels citywide.

An evaluation of ATTOM and U.S. Census Bureau information by ABC Owned Tv Stations confirmed one possible cause for this disparity: disproportionate property taxes.

Property taxes are primarily based on a authorities evaluation of every dwelling’s worth. However researchers say property values are extremely subjective, and these estimates do not all the time align with market costs.

Information reveals discrepancies in assessments — and subsequently tax payments — have an effect on some communities greater than others.

ABC’s evaluation discovered that throughout the nation, householders in predominantly Black and Brown areas are likely to pay larger taxes than these in largely white neighborhoods for a home price the identical quantity on the open market.

“When property tax methods are full of distortions the individuals punished are typically the poorest householders,” Levy mentioned. “In suburbia, the place you may have a excessive degree of segregation, the people who find themselves being taxed unfairly primarily based on not precisely capturing the worth of the house are individuals of colour.”

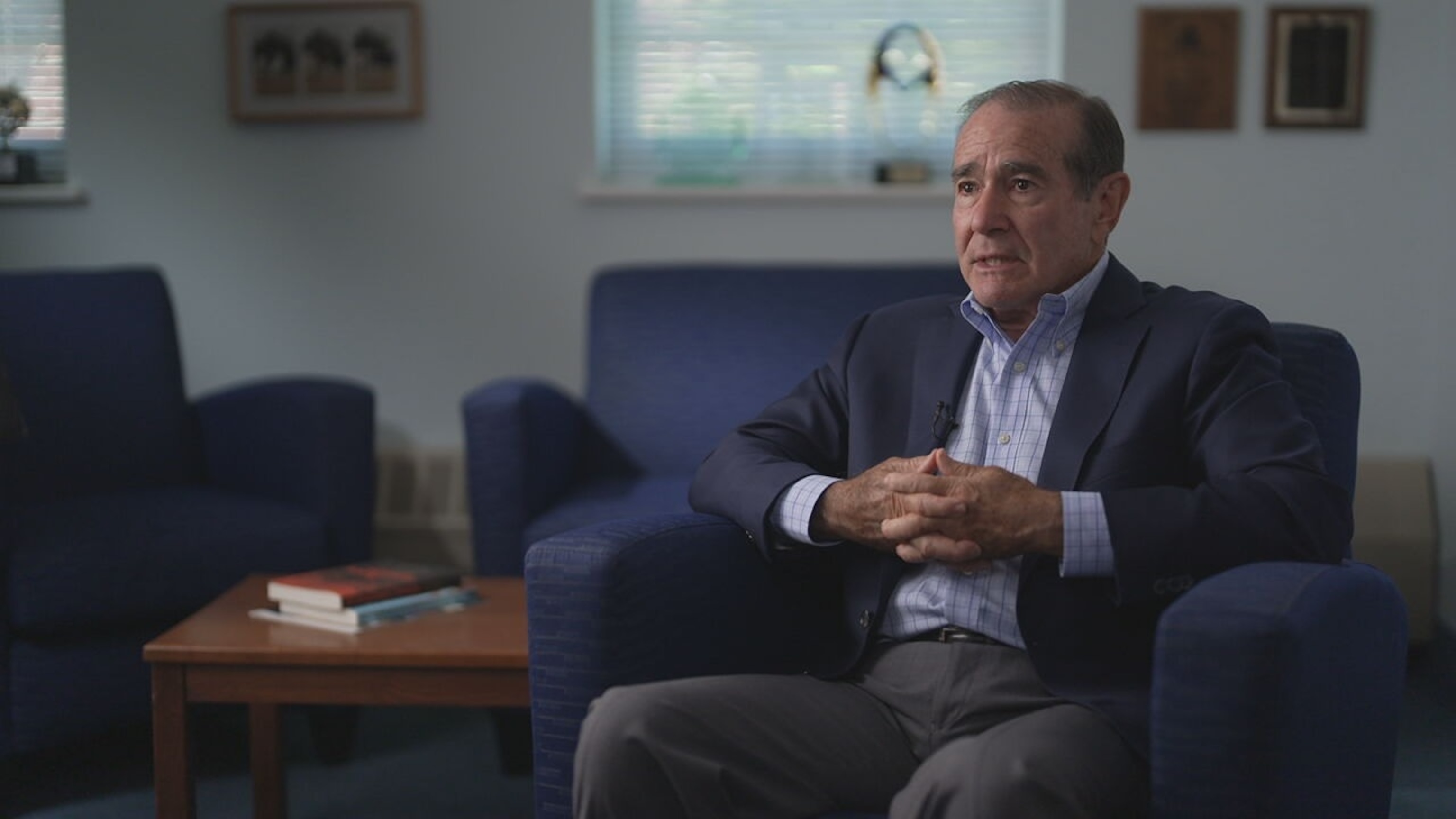

Lawrence Levy is the chief dean on the Nationwide Heart for Suburban Research at Hofstra College on New York’s Lengthy Island.

ABC Information

For a few of these householders who’re “highballed” on their assessments, missed payments result in tax gross sales, leaving them with nothing. From the time Anderson purchased her dwelling till she misplaced it, the property’s evaluation greater than tripled — however the dwelling’s booming worth in the end went to its new proprietor.

“I do not know what’s worse, shedding the home or being recognized with most cancers,” Anderson mentioned. “It hurts nonetheless.”

Till not too long ago, Levy famous, tax gross sales most frequently passed off in cities. As city neighborhoods gentrified and property values shifted quickly, longtime residents could not all the time sustain with rising payments.

“We’re now beginning to see extra of that in suburban areas, significantly within the poorer suburban areas as we’re seeing demographic change,” Levy mentioned.

In Backyard Metropolis, a predominantly white suburb on New York’s Lengthy Island with a median dwelling worth of round $1 million, a typical residential tax invoice is round $10,000 to $15,000, property information reveals.

Down the highway in Hempstead, the place 88% of residents are Black or Latino, houses are typically price lower than half that. However the typical tax invoice is analogous, that means Hempstead householders pay proportionally extra in taxes relative to the worth of their houses.

John Rao, senior legal professional on the Nationwide Client Legislation Heart, says U.S. householders in communities of colour face a “double whammy.” They typically obtain “lowballed” appraisals when attempting to buy or refinance their houses, Rao defined, “however with regards to paying their taxes, as soon as they’ve owned the house … typically their assessments are proportionally larger than what they need to be.”

‘Stripping generational wealth’

In suburban Delaware County, Pennsylvania, 91-year-old Gloria Gaynor, who suffers from dementia, misplaced her dwelling of 25 years due to $3,500 in taxes she did not pay throughout the COVID-19 pandemic.

Gaynor’s daughter, Jackie Davis, told ABC station WPVI-TV that her mom stayed dwelling throughout the pandemic. She skipped her annual journey to the tax workplace after listening to that tax collectors had paused enforcement as COVID-19 unfold by means of the Philadelphia suburbs.

When the federal government restarted assortment efforts and the county tax workplace reopened, Gaynor went in and made a fee, aspiring to cowl her earlier yr’s taxes, in line with her legal professional, Alexander Barth.

As a substitute, the cash was utilized to Gaynor’s 2021 and 2022 taxes and never her excellent stability from 2020, “leaving what is basically a donut in her tax fee historical past,” Barth defined.

Jackie Davis is seen caring for her 91-year-old mom, Gloria Gaynor.

WPVI

An actual property investor purchased Gaynor’s dwelling from Delaware County for $14,000, the price of her overdue taxes plus curiosity and charges.

Gaynor had paid off most of her mortgage on the home, which is now price an estimated $247,000. However she didn’t make any cash from the sale.

“That is stripping generational wealth from the have-nots and permitting the haves to have it,” Barth mentioned.

Gaynor’s household went to courtroom in an try to get again her dwelling, however two courts upheld the sale.

The Delaware County Tax Declare Bureau informed ABC’s Philadelphia station that whereas it “sympathizes with the emotional toll” on Gaynor, the county authorities acted inside Pennsylvania legislation and issued a number of notices forward of the sale.

If Gaynor had lived just some miles away inside Philadelphia’s metropolis limits, officers there would have taken additional steps to attempt to maintain her in her dwelling.

Since property taxes are dealt with in a different way in numerous communities, some native governments like Philadelphia have layers of safety for weak householders, akin to requiring in-person notifications earlier than a tax sale or providing fee plans to redeem a house afterward.

“Though native governments ought to do every thing they will to maintain individuals of their houses, whether or not it is an proprietor or a renter, sooner or later they’ve an obligation to all the opposite taxpayers, the companies, the households which can be paying their fair proportion to ensure that these taxes are collected,” Levy mentioned.

From the lounge to the courtroom

Simply over 90 miles down the highway from Gaynor, Anderson spends her days trying again on the reminiscences she constructed within the dwelling that was as soon as the centerpiece of her household.

Now residing along with her daughter in a Baltimore suburb, Anderson has taken her case to courtroom, becoming a member of a lawsuit claiming that the Metropolis of Baltimore broke federal legislation by promoting her former dwelling to a non-public firm for pennies on the greenback.

The Metropolis of Baltimore, which didn’t reply to ABC Information’ requests for remark, has defended its actions in courtroom, saying it notified Anderson as required and didn’t revenue from the sale.

In 2023, the U.S. Supreme Courtroom dominated that native governments couldn’t revenue from tax gross sales, discovering that householders have a constitutional proper to any funds past the taxes and penalties they owe.

Over the past two years, many states throughout the nation have modified their legal guidelines in mild of the courtroom’s determination. However some consultants say the federal authorities additionally has a task to play.

Bonita Anderson (left) informed ABC Information Senior Political Correspondent Rachel Scott that she was “baffled” by the lack of her Baltimore dwelling.

ABC Information

“The federal reply to decrease native property taxes is extra funding for native companies,” Levy mentioned. “They want extra assist from Congress and the White Home.”

Because the Trump administration has slashed the federal budget, native governments must make up the distinction to supply the identical companies.

In response to consultants, municipalities will possible rely extra on property taxes, which in flip, might imply extra conditions like Anderson’s, the place householders in majority-nonwhite neighborhoods too typically pay greater than their fair proportion.

When requested by ABC Information what occurred to her dream of passing down her dwelling to the following era of her household, Anderson mentioned, “it died.”

“It nonetheless makes me emotional,” Anderson mentioned. “It is simply onerous. Very onerous.”

ABC Information’ Meghan Mistry, John Santucci and Lucien Bruggeman together with ABC Owned Tv Stations’ Ryann Jones, Maggie Inexperienced, Jason Knowles, Cheryl Mettendorf, Chad Pradelli, Dan Krauth, David Paredes, Ross Weidner and Sarah Rafique contributed to this report.