The Authorities of President Boakai is reportedly reconsidering the failed EBOMAF deal below his predecessor, George Weah, the NEW DAWN has discovered.

By Stephen G. Fellajuah

Monrovia, Liberia; October 17, 2025 – The controversial Elton & EBOMAF infrastructure financing deal, as soon as thought of lifeless, has resurfaced below the administration of President Joseph Boakai, years after it stalled in the course of the George Weah period.

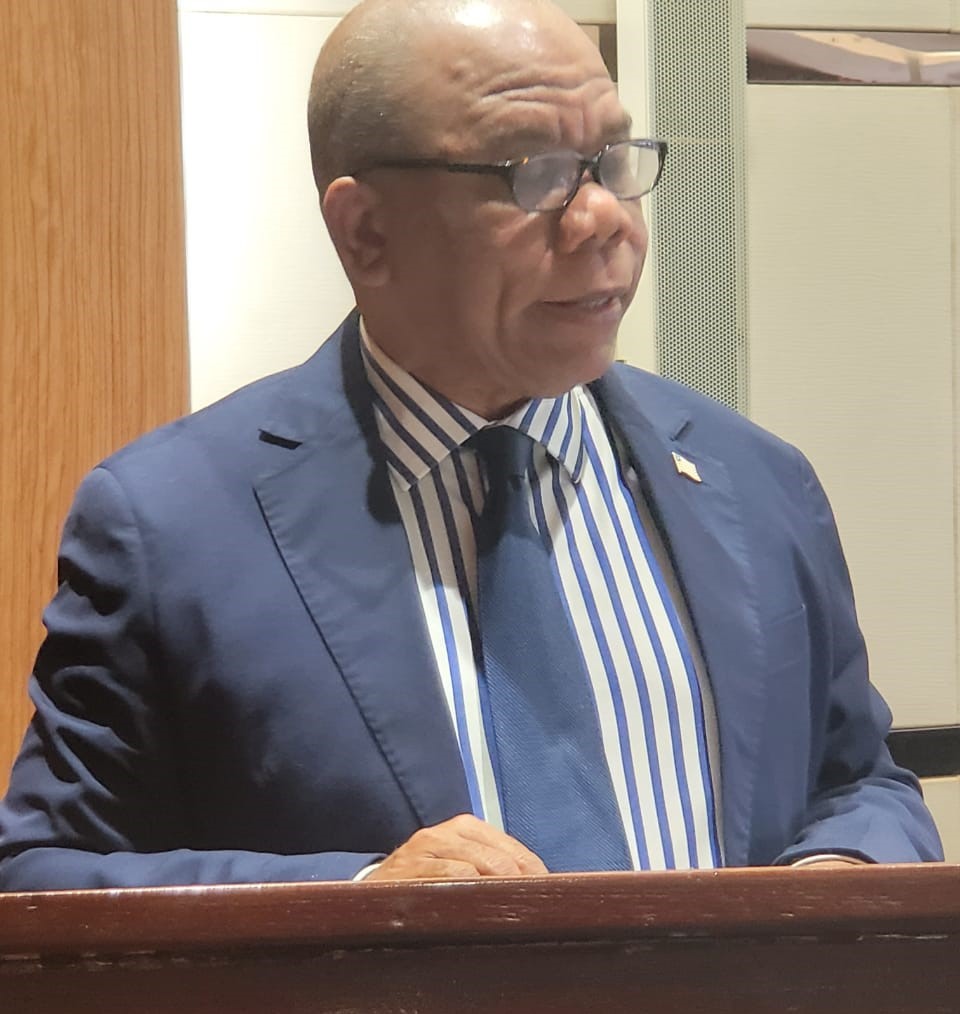

The revelation was made right here on Thursday, October 16, 2025, by Grand Kru County Senator Albert Tugbe Chie, who chairs the Senate Committee on Public Works and Rural Improvement, in the course of the opening of the third and Remaining Quarter of the 2nd Session of the fifty fifth Legislature.

“I’ve been knowledgeable that the federal government has been contacted concerning the Elton & EBOMAF Deal”, stated Senator Albert Tugbe Chie. He made the assertion whereas briefing his colleagues on developments in the course of the constituency break.

The Elton & EBOMAF Deal traces again to 2018, when the Weah administration introduced two main infrastructure financing agreements, together with US$536 million with Eton Finance PTE Ltd (Singapore) to fund coastal hall highway development, and US$420.81 million with EBOMAF SA (Burkina Faso) to assemble and improve highway corridors in Monrovia and northeastern Liberia.

The contracts, as soon as they have been ratified by the Legislature and signed by the President, have been set for multi-year implementation (36–48 months). Disbursements have been anticipated inside a set variety of “banking days” following ratification and the issuance of sovereign ensures.

Regardless of the early fanfare, each offers shortly turned mired in controversy, sparking considerations from lawmakers, civil society, and worldwide companions. Among the many key pink flags, Eton Finance was reportedly “struck off” from the Singapore registry earlier than the deal was finalized, elevating doubts about its legitimacy and monetary capability.

EBOMAF, managed by Burkinabé businessman Mahamadou Bonkoungou, was linked to President Weah via reviews of offering a personal jet, prompting allegations of battle of curiosity.

The offers lacked transparency. There have been no publicly vetted feasibility research, price assessments, or threat reviews.

Some contract clauses appeared contradictory and non-standard, mixing language on sovereign ensures, bond issuance, and complicated disbursement phrases.

Although the offers have been ratified, no funds materialized throughout the stipulated timeline. The “50 banking day” disbursement clause got here and went with none precise transfers.

The Worldwide Financial Fund (IMF) and exterior observers raised alarms over Liberia’s publicity to non-concessional debt, warning of potential fiscal instability.

By 2020, the Ministry of Finance unofficially declared the offers “put aside.” Even then, Finance Minister Samuel Tweah acknowledged that the agreements contained default clauses and might be canceled for non-performance.

“The contracts had default clauses and might be canceled in the event that they did not comply”, stated Tweah in 2018.

The federal government finally turned to extra conventional financing mechanisms, resembling loans and grants from the World Financial institution, to assist infrastructure growth.

With information that the Boakai-led authorities could also be reconsidering the Elton & EBOMAF deal, critics warn that each one earlier considerations nonetheless stand. Enhancing by Jonathan Browne