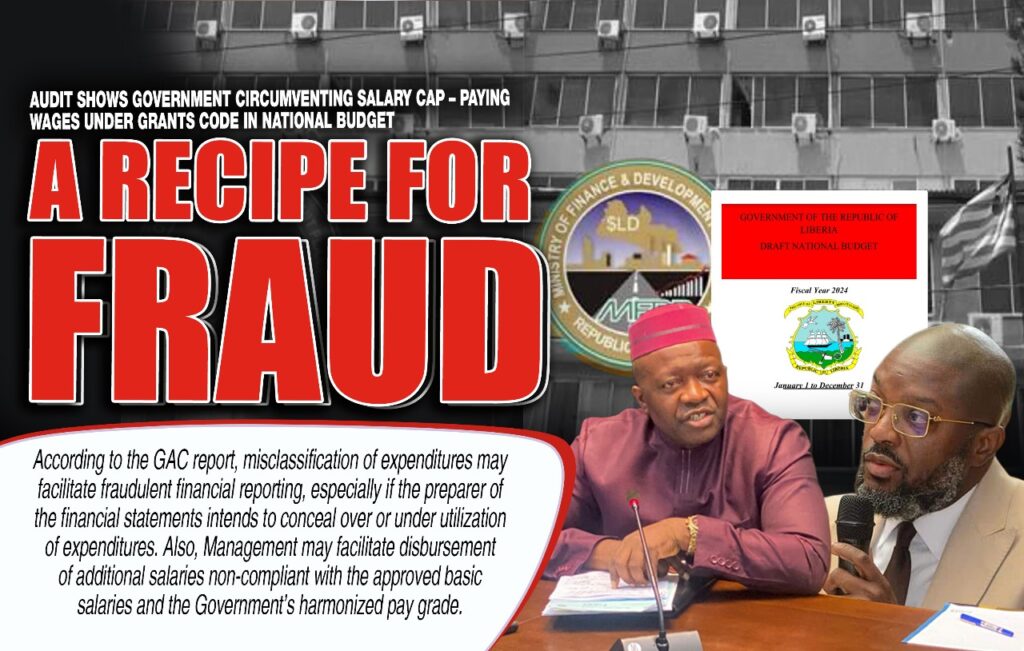

Monrovia — An audit by the Normal Auditing Fee (GAC) has revealed that the Ministry of Finance and Growth Planning could also be circumventing the authorised wage construction by disbursing wages underneath the “Grants/Transfers” class within the nationwide funds, as an alternative of the usual “Primary Salaries” allocation.

By Gerald C. Koinyeneh, [email protected]

The GAC report warns that this misclassification of expenditures creates a “recipe for fraud”, doubtlessly enabling fraudulent monetary reporting if used to hide over- or under-utilization of funds. It additionally famous that administration might exploit the system to launch further salaries that don’t adjust to the federal government’s harmonized pay grade.

In response, the Ministry of Finance and Growth Planning (MFDP) acknowledged the audit’s findings however offered context. The ministry defined that some establishments, together with Grand Kru Technical School (GKTC), are solely allotted funds underneath the Grants/Transfers (26) class by the Finances Division, somewhat than Primary Salaries (21). Each wage and operational funds for these establishments are comprised of their grants allocation.

“Administration appreciates the audit statement. Kindly notice that there are a few establishments which can be solely allotted ‘Grants/Transfers’ as an alternative of ‘Primary Salaries’ by the Finances Division. Subsequently, each wage and operational funds are made to these establishments from their allotted grants,” the ministry stated.

The audit additional revealed that throughout the fiscal yr January 1, 2024, to December 31, 2024, the federal government disbursed US$282,846,300 in wages, salaries, and worker advantages, in comparison with US$301,161,000 in 2023. Nonetheless, pattern transactions confirmed that US$9,831,337.51 was disbursed to workers at a number of authorities establishments—together with the Nationwide Legislature, Ministry of State for Presidential Affairs, Ministry of Inner Affairs, and MFDP—underneath Grants/Transfers as an alternative of the wage code, successfully circumventing the federal government’s wage ceilings.

The GAC advisable that all wage funds be consolidated underneath Primary Salaries and operational funds underneath Operational Bills within the nationwide funds. Solely non-compulsory present or capital transfers from different authorities models or worldwide organizations needs to be categorized underneath Grants, per the authorised chart of accounts.

The MFDP agreed with the suggestions and clarified that “specialised models” inside establishments allotted Primary Salaries obtain Grants/Transfers as a result of their workers are usually not on the principle payroll. The ministry confirmed it can work with the Finances Division to create Primary Wage codes for all establishments receiving Grants/Transfers and incorporate workers of specialised models into the principle payroll.

The report additionally flagged broader compliance points: out of 18 ministries and 93 businesses/municipal authorities, 12 establishments—about 9% of reporting entities—didn’t submit monetary statements essential for consolidation. These included the College of Liberia (US$31,113,410), Ministry of Inner Affairs (US$17,104,050), and William V.S. Tubman College (US$5,578,630). Many monetary statements weren’t absolutely compliant with IPSAS Money Foundation or IFRS requirements, and a number of other weren’t submitted to the Auditor Normal as required by regulation.

IPSAS Money Foundation is a set of accounting requirements issued by the Worldwide Public Sector Accounting Requirements Board that gives steering on how governments and public sector entities ought to file and report monetary transactions utilizing the money foundation of accounting. Whereas IFRS is an acronym for Worldwide Monetary Reporting Requirements.

The GAC urged the Workplace of the Comptroller and Accountant Normal (CAG) to withhold remuneration of heads and comptrollers of ministries, businesses, and commissions (MACs) that fail to submit monetary statements on time. The MFDP has accepted this advice and pledged to make sure all MACs comply going ahead.

Moreover, the audit confirmed that reconciled money balances as of December 31, 2024, amounted to US$27,950,000, suggesting that under-disbursement to 106 entities totaling US$78,289,600 might have restricted their potential to attain mandated aims.

Consultants warn that continued misclassification of wage funds erodes belief in public monetary administration and will complicate future audits, particularly if misclassifications are used to approve wage will increase with out legislative authorization.

The audit additionally highlights longstanding challenges: earlier GAC experiences have uncovered repeated shortcomings and misapplication of public assets. Regardless of suggestions for investigations and prosecutions, little substantive motion has been taken. Many audit experiences stay caught in Legislature committees and archives, elevating questions on whether or not the Legislature and Govt are fulfilling their shared duty of making certain efficient checks and balances.

As Liberia continues to grapple with fiscal constraints, observers say the audit raises pressing questions on compliance with wage legal guidelines, transparency in funds execution, and accountability in public monetary administration.